9.37 Two Bonds: Same Duration, Different Convexities

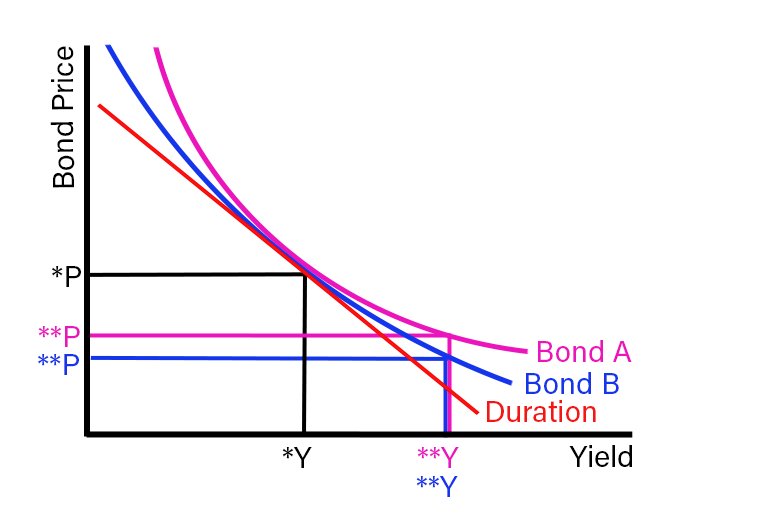

Think of this. It is possible to have two bonds with the same durations, but different convexities, e.g., a short-term zero and a longer-term positive coupon bond. They may both have the same durations, but the zero has greater convexity; its price-yield curve is “curvier.” This was discussed above.

Which is the zero-coupon bond and which is the positive coupon one? Which bond has more convexity, more curvature? Which moves more in price for a given change in yield?

Bond “A” has greater convexity!