9.14 The Duration Analog

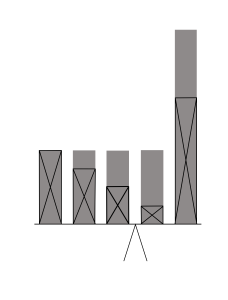

Once again, we have a visual analog. This time, think of the rectangles as glasses filled with varying amounts of water represented by the Xs. The height of the glasses represents the nominal values of the cash flows, whereas the water levels represent the present values. The glass to the far left is full; it has the highest present value because it is so soon to be paid off. Definition:

Definition:

Duration is the weighted average life of the present value of the bond’s cash flows.

The analog is a visualization of this definition. The point at which the fulcrum is located represents the weighted average of the life of the present value of the bond’s cash flows, i.e., its Duration.

Question:

What happens to Duration on coupon payment date? (Hint: The coupon “glass” falls off and – in order to rebalance the seesaw – the fulcrum moves to the….)

Assumptions Concerning Duration:

- Instantaneous changes in yield and price

- Small changes in yield

- For large changes in yield, the duration estimate will be inaccurate as will be seen.

- Parallel shifts in the yield curve

Note:

Duration is intended to address the price/reinvestment effects conflict; duration is the holding period, which balances the two effects, as we will see soon.