9.27 Pricing Errors Due to Duration Estimates

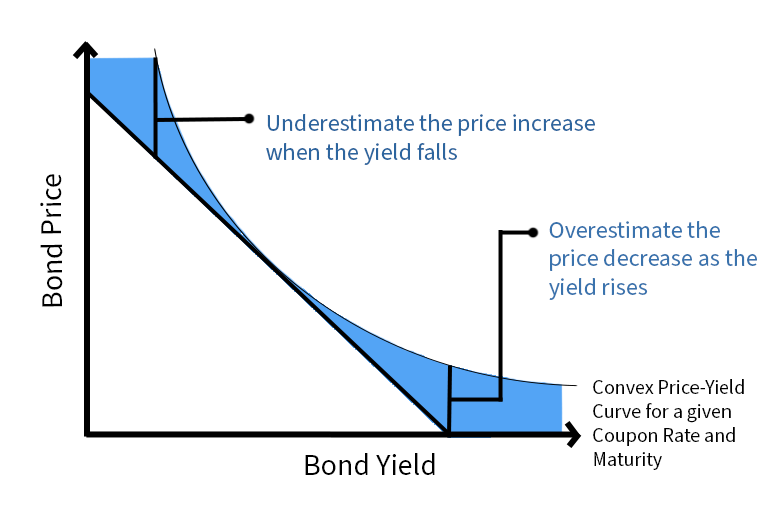

As noted on the prior page, as actual yields deviate increasingly from the Duration-based price estimate, the dollar price will also deviate increasingly from the price originally estimated by Duration. This is because the Duration-based estimated price is based on a linear expression whereas the actual Price-Yield Curve is curvilinear. Duration is a linear estimate of the slope of the Price-Yield at a point on the curve.

One may also take note that the errors are asymmetric – as viewed in opposite directions – as one observes yield changes in opposing directions. That is to say, dollar prices increase more when yields decrease than prices decrease when yields rise. The error is greater to the right than it is to the left. This should give investors some solace as prices will rise more than they potentially fall for the same change in yield.

The explanation for this has to do with the bond’s “Convexity” or curvature, a concept which will be discussed in detail below. With respect to Duration and the Price-Yield Curve, we already noted that the curve increases increasingly to the left.

The graph below depicts these notions. In reviewing the graph, remember also that the Price-Yield Curve can pierce the vertical axis when interest rates turn negative AND that the curve is asymptotic to the vertical axis.